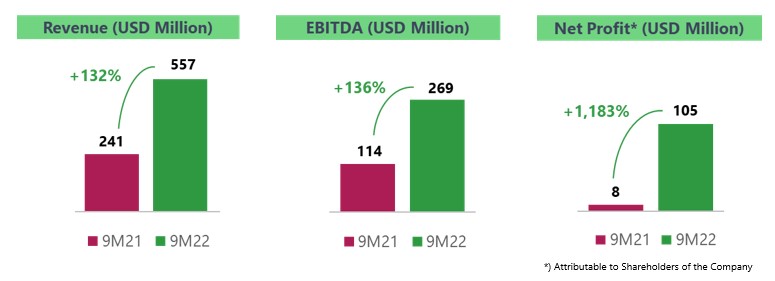

Jakarta, 10 October 2022 – PT Surya Esa Perkasa Tbk. (ESSA: IJ), a publicly listed company engaged in the Energy and Chemical sectors through its LPG (Liquefied Petroleum Gas) Refinery and Ammonia Plant, once again reported a brilliant performance for the nine months period ended 30 September 2022. ESSA booked record Revenue of USD 557 million, a significant increase of 132% YoY and EBITDA of USD 269 million, an increase of 136% YoY, backed by robust operations and favorable market conditions.

Global commodity markets continue to remain elevated with the geo-political situation further fueling the prices upward. Ammonia & LPG prices continued at higher levels following the high gas & crude oil prices around the world. With further gas supply constraints in Europe due to the Russia-Ukraine conflict, gas prices have remained elevated with a knock-on effect on ammonia production cost. Ammonia prices in Asia have stabilized at a higher level of around USD 900/MT in-line with global prices.

ESSA’s realized Ammonia prices in 9M22 soared by 105% YoY to USD 902 per metric ton (MT) compared to USD 441 per MT in 9M21. Further Ammonia production increased by 16% YoY resulting into record earnings at the Ammonia business which contributed 93% to ESSA’s revenue in 9M22.

Chander Vinod Laroya, ESSA’s President Director, commented on the results for 9M-2022:

“Consistent operational excellence supported by the higher Ammonia & LPG prices have helped ESSA to maintain solid performance. ESSA remains committed to continuously adding value to Indonesia’s resources by investing in the real sector, developing human capital, and creating opportunities for further growth.

Besides Blue Ammonia, ESSA is also exploring various gas related downstream opportunities as we remain committed to delivering greater value for shareholders by further growing the business.”

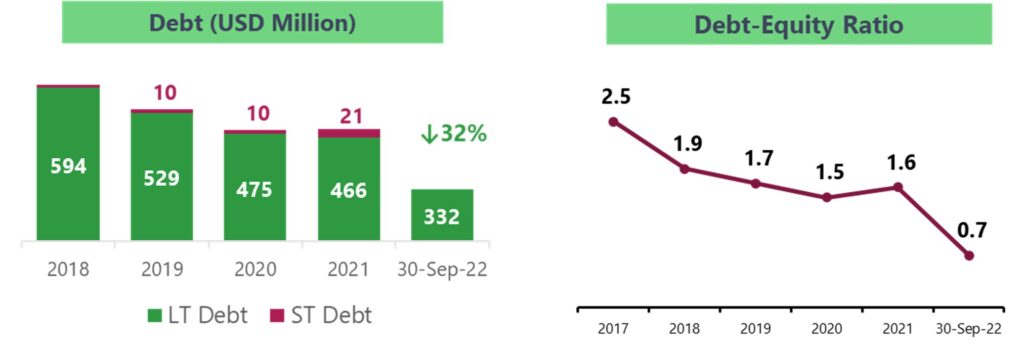

ESSA has utilized the higher cash generated to deleverage bringing down the debt by 32% to USD 332 million at end September 2022 compared to USD 487 million at end December 2021. This has led to a stronger balance sheet with the Debt-to-Equity ratio now at 0.7x.

ESSA through its subsidiary PT Panca Amara Utama (PAU), has continued the feasibility study of the Blue Ammonia project in accordance with the Memorandum of Understanding (MoU) with Japan Oil, Gas, and Metal National Corporation (“JOGMEC”), Mitsubishi Corporation (“MC”), and Institut Teknologi Bandung (“ITB”) in March 2021.

PAU has further signed an MoU with JGC Corporation in August 2022 to measure Greenhouse Gas (GHG) emissions at its Ammonia plant. The collaboration of PAU with JGC is expected to contribute to the improvement of guidelines on clean ammonia production, another step closer to Blue Ammonia for a better and cleaner world. The feasibility study and the GHG measurement are expected to be completed by mid-2023.

For further information, please visit our website www.essa.id or contact:

Shinta D. U. Siringoringo

Corporate Secretary

Phone: +62 21 2988 5600

Email: corpsec.sep@essa.id

Aditya

Media Relations Team

Phone: +62 812 9548 6465

Email: investor.relations@essa.id