Jakarta, 20 February 2023 – PT Surya Esa Perkasa Tbk. (ESSA: IJ), a publicly listed company engaged in the Energy and Chemical sectors through its LPG (Liquefied Petroleum Gas) refinery and Ammonia plant, achieved record earnings riding on excellent operations and favorable market conditions in 2022.

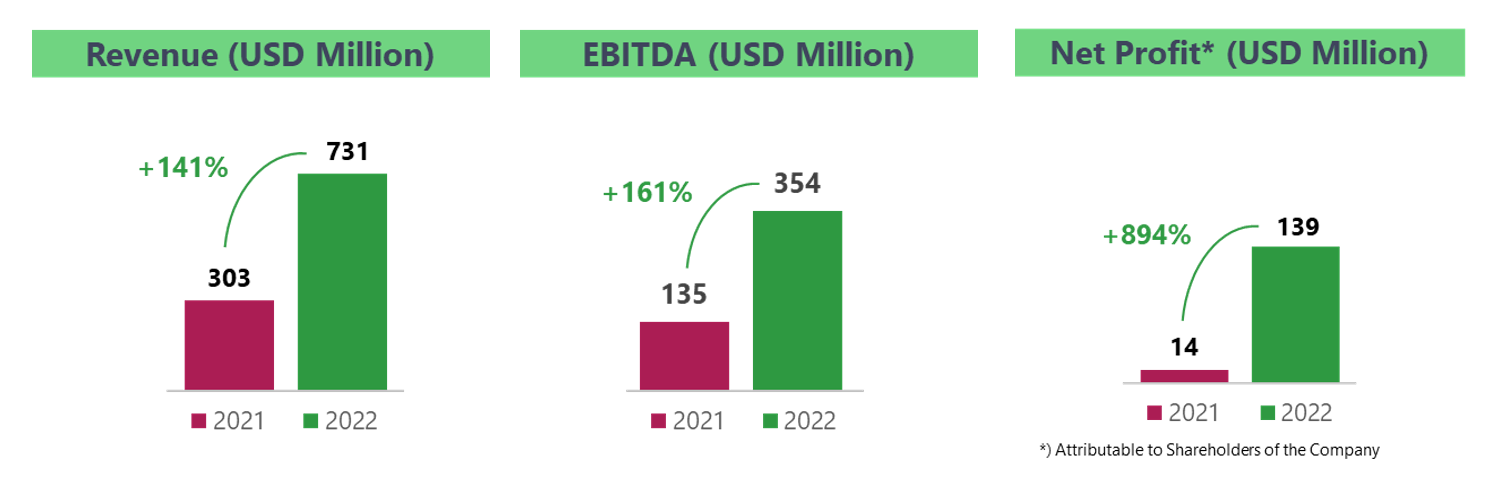

ESSA reported its highest ever Revenue of USD 731 million (up by 141% YoY) & EBITDA of USD 354 million (up by 161% YoY) in the consolidated financial statements for year 2022 released today.

Global commodity markets remained elevated with the geo-political situation fueling the prices upward. Europe saw a record spike in natural gas prices which compelled industries to scale back their capacities. ESSA’s Ammonia realized prices soared by 91% YoY to USD 887 per metric ton (MT) while Ammonia production increased by 34% YoY to 760,815 MT resulting in record earnings at the Ammonia business which contributed 93% to ESSA’s Revenue in 2022.

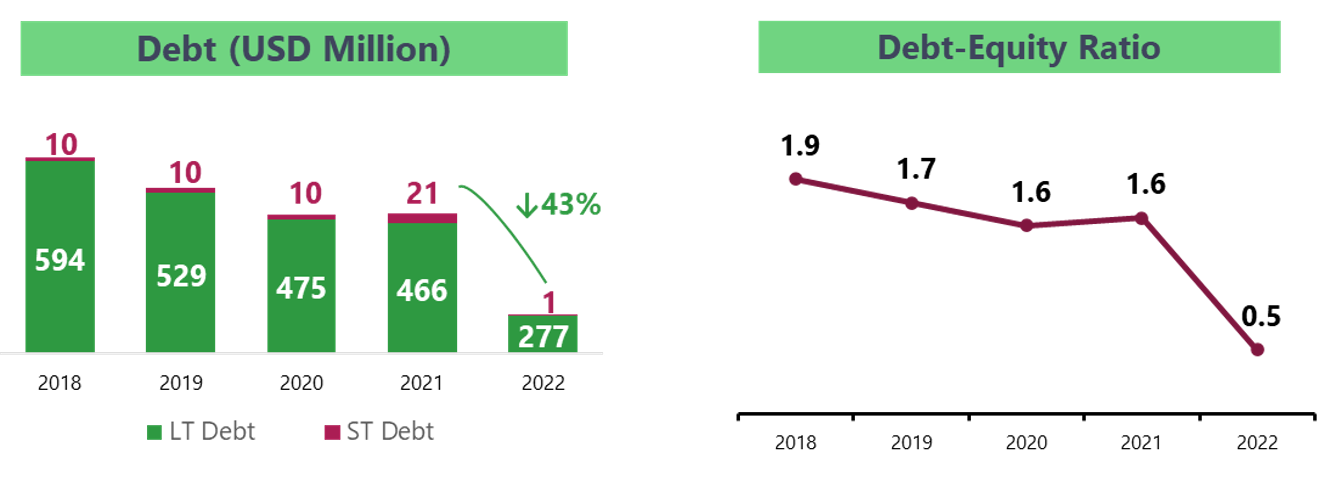

As a result of the strong cash flow, ESSA’s debt reduced significantly by 43% to USD 278 million at end December 2022 as compared to USD 487 million in 2021 with the Debt-to-Equity ratio now at 0.5x.

Chander Vinod Laroya, ESSA’s President Director, commented on the performance in 2022:

“We are pleased to announce our highest ever earnings in 2022, building on the consistent operational excellence supported by the higher Ammonia & LPG prices. ESSA has utilized the higher cash generated to de-lever, leading to a much stronger balance sheet. Furthermore, we distributed a dividend in 2022 for the first time since our initial public offering in 2012.

Our focus on ESG remains strong starting with the Blue Ammonia project which is widely being explored for use as alternative cleaner fuel. ESSA’s Ammonia plant has received the Green PROPER award from the Ministry of Environment and Forestry, an achievement only few have attained, depicting our strong commitment towards the environment.

Going forward, we remain optimistic about new growth opportunities in the gas-downstream industries to deliver greater value for shareholders by further growing the business.”

For further information, please visit our website www.essa.id or contact:

Shinta D. U. Siringoringo

Corporate Secretary

Phone: +62 21 2988 5600

Email: corpsec.sep@essa.id

Aditya

Media Relations Team

Phone: +62 812 9548 6465

Email: investor.relations@essa.id